Pair Configuration

Learn how to configure your trading pair parameters in Vixor.

⚙️ Pair Configuration

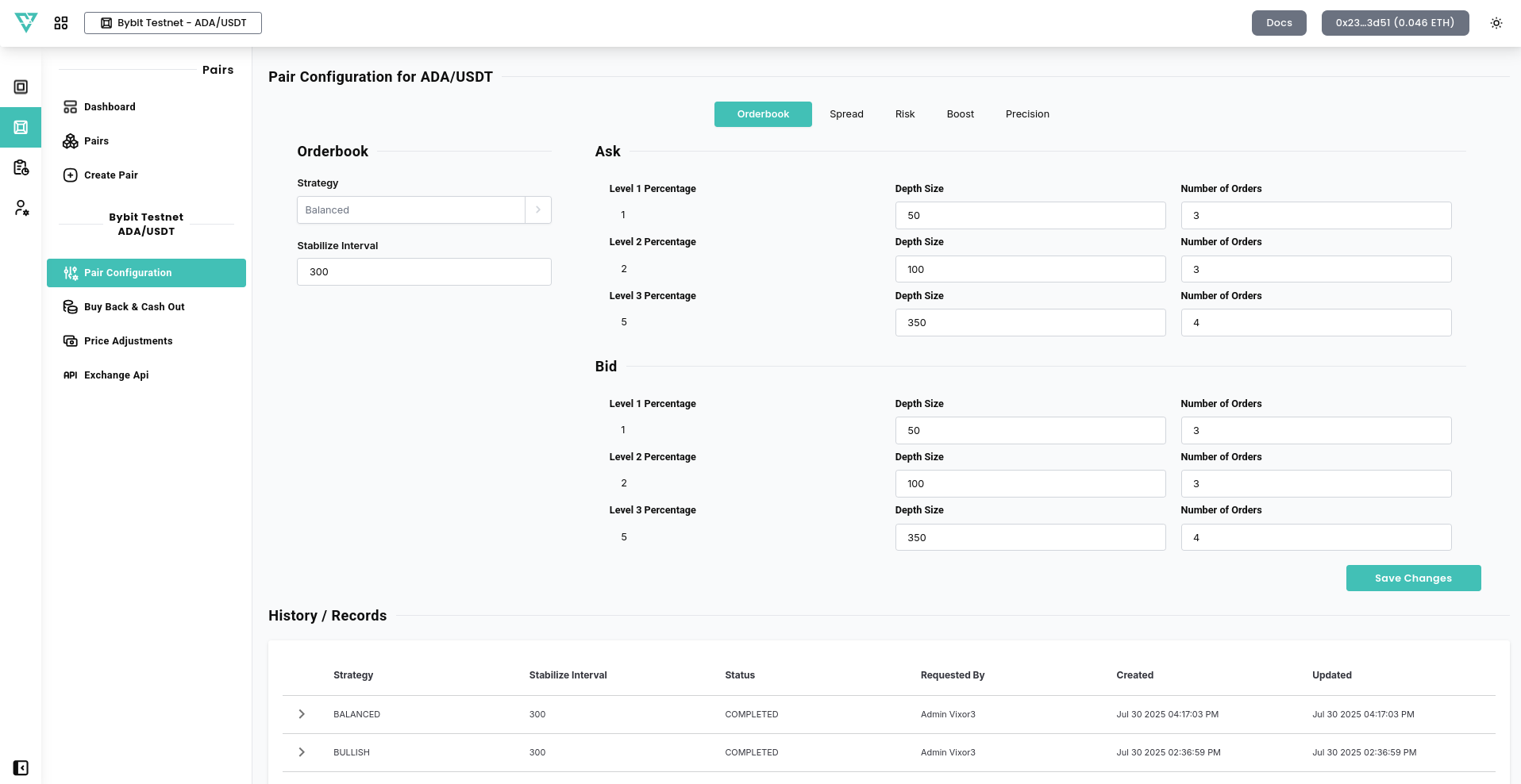

Once a trading pair is created and enabled, you can fine-tune its behavior using the Pair Configuration panel. This section allows you to adjust your market-making strategy, risk limits, price precision, spread, and boost settings.

🧩 Key Sections in Pair Configuration

📘 Strategy & Orderbook Setup

- Strategy: Select your trading behavior (e.g.,

bearish,balanced,bullishoradvanced). - Stabilized Interval: Defines the frequency (in seconds) for rebalancing orders.

- Bid/Ask Levels: Configure order depth and number of orders per level on both buy and sell sides.

📏 Spread Settings

- Minimum Spread: Sets the tightest price difference between buy and sell orders.

- Maximum Spread: Prevents overly wide spreads that can harm trading efficiency.

🎯 Precision Controls

- Price Precision: Decimal precision for order prices.

- Amount Precision: Decimal precision for order amounts.

🛡️ Risk Limits

- Balance Limits: Define how much of each token (e.g., ADA and USDT) can be used in MM activities.

- Price Limits: Risk configuration also supports setting maximum/minimum price thresholds which is optional.

⚡ Boost Settings

- Boost Status: Toggle price boost mode for increased exposure.

- Boost Size: Define min/max size for boosted orders.

- Boost Spread & Interval: Control how aggressively boosted orders are placed and how often.

📜 History / Records

At the bottom of the page, the History / Records section displays all previous config changes. This allows you to:

- Monitor past actions

- Audit market activity

- Analyze strategy effectiveness

You can return to this log at any time to review execution status and improve your future configurations.

All of these parameters work together to shape how your selected trading pair behaves in the market. After adjustments, your configuration will be applied automatically and reflected in real-time across integrated exchanges. All these changes will be recorded in the History section for transparency.